Fine Arts Boosters to make possible fundraising changes

May 25, 2017

Due to the belief that individual student fundraising is out of compliance with International Revenue Services (IRS), the Fine Arts Boosters will be adhering to possible changes.

Currently, when a student participates in a Fine Arts Booster fundraiser, the profits from the sales go into an individual student account that is maintained by the Fine Arts department. Students may use the money they raise to pay for any Fine Arts related expenses like class trips, supplies, and equipment.

When a student graduates with money left in their account, the money goes to either a younger sibling involved in the Fine Arts program, or it goes into a general scholarship fund. However, the Boosters will fund special purchases of equipment. Previously, a piano for the choir room and display cases for three-dimensional artwork have been purchased.

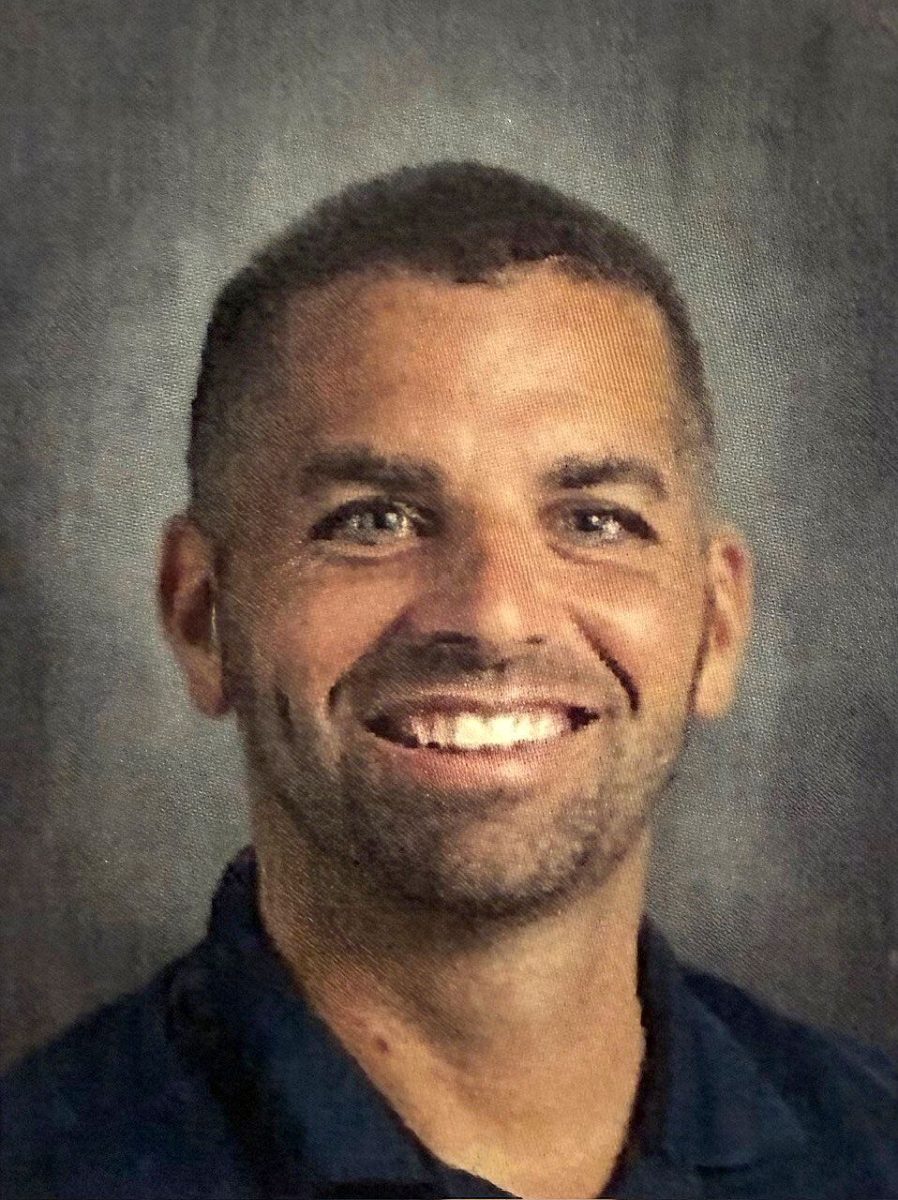

Fine Arts chairperson Brayer Teague is involved in and oversees the Boosters. “The parents are reviewing the fundraising structures to make sure that we adhere to the guidelines of the Internal Revenue Service and laws relative to not-for-profit organizations,” Teague said.

As for what that will mean for students’ individual accounts, they may cease to exist. “If we are not in compliance, we will clearly have to adjust our practices to align with tax laws. That may mean that we have to eliminate individual student accounts,” Teague said. “The Fine Arts Boosters, as a parent organization, do a lot more than just manage individual accounts for students. They also do things that support the entire Fine Arts Department. That won’t change, for sure. If we have to pivot away from individual accounts, I think they will use that time and space to do more to help everybody.”

Rather than having individual student accounts, if the Fine Arts Boosters are out of compliance with tax laws, there may be fundraisers that include all students, and the money raised from those will be evenly distributed to those students. “That’s not a violation of tax laws, or not-for-profit tax law. What you’re not allowed to do is let the student use an individual checking account that is tax free,” Teague clarified.

According to poll sent out by Teague to Fine Arts students, 30% of music students occasionally participate in fundraising programs sponsored by the Boosters. “We have far fewer students utilizing these accounts than the average music student might think. We had about eight to ten percent of music students using them and, really, a much smaller percent of students than that using them robustly,” Teague said.

As for student thoughts on this, junior Jen Casey has robustly used her individual student account to pay for band trips and equipment. “My parents have pushed me really hard to do these fundraisers, but we could potentially do what [psychology club] does with brain awareness week and sell things that go into a general fund,” Casey said.

If the Boosters are in violation of tax laws, Teague has stated that the Fine Arts department will make a switch from individual student accounts to general fundraisers that students can participate in. Rather than the money earned from these fundraisers going into an individual account, it will be evenly dispersed to each student that participated.